|

|

When it comes to the cost-of-living crisis, the world of content faces a struggle. Audiences are typically being offered one of two things: simplistic money saving tips or an impenetrable economic treatise. Where’s the middle ground?

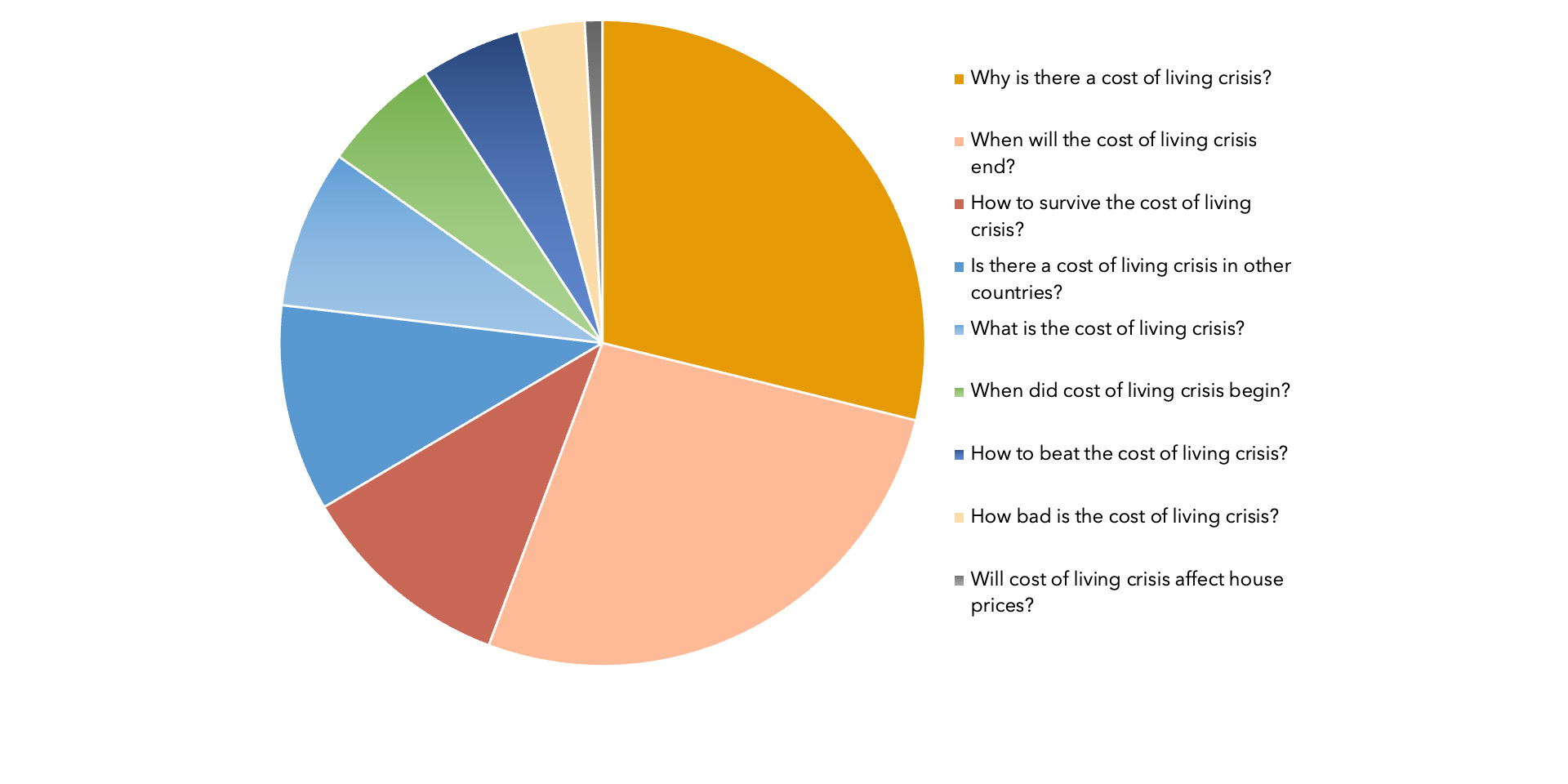

If we look at the top search terms, people are asking two fundamental questions:

- Why is there a cost-of-living crisis?

- When will it end?

As UK households collectively hold their breath for their next energy bill, they want to know if there is light at the end of the tunnel, and why that tunnel exists in the first place.

While the saving tips and the intricate reports are useful, communicators must demonstrate their authority and trustworthiness by succinctly answering their audience’s questions. This means breaking down these complex answers and explainers into jargon-free, authoritative yet engaging content.

We gave our Head of Editorial, Eddie Ansell, 500 words to demonstrate how.

Let’s start with the why

The primary cause is inflation. The Consumer Prices Index (the average price of a basket of goods) hit 10.1% in September, driven in particular by food costs jumping 14.6% year-on-year, their fastest rate in 42 years.

There are two stand out reasons for this rise. Firstly, the Covid-19 pandemic caused huge disruption to the global supply chain. Multiple national lockdowns slowed or even halted the flow of both raw materials and finished goods around the world. This lack of supply was exacerbated by a surge in demand after restrictions were lifted and people sought to spend the money they had saved during the pandemic. Not enough products and lots of demand pushes prices up.

Secondly is Russia’s invasion of Ukraine, which had a massive impact on the core commodities that we all rely on – food and energy. Russia is the world’s third-largest producer of oil and second-largest producer of natural gas. Meanwhile, Ukraine is called the breadbasket of Europe for a reason, producing 10% of the world’s wheat, 15% of its corn, 13% of its barley, and almost half its sunflower oil. Cuts in the supply of these due to the conflict prompted a big spike in prices.

The other side of the coin to inflation is wages. While prices have gone up, salaries haven’t, meaning households are worse off in real terms. Low wage growth is a longer term trend, caused by a mix of low productivity growth and a struggling post-Brexit economy.

So, when might it end?

Given inflation is the key driver to this, have we reached a peak or is there more misery to come? Well first the bad news, the Bank of England said it expects the rate of inflation to continue rising to the end of this year, peaking at 11% in October and likely to ‘remain above 10% for a few months before starting to come down’. However, both the Bank and financial analysts do see inflation falling throughout 2023, potentially falling in line with the official 2% target within two years. And as inflation eases, so does the pressure to increase interest rates which should prevent mortgage rates rising further.

For households, energy bills remain the most notable expense. The UK Government did announce the Energy Price Guarantee scheme freezing typical energy bills at £2,500 from October. However, this is only set to run to April 2023 and some estimates suggest that energy bills could remain high until 2024.

How might they come down? Well, there is room for additional government support such as extending support payments or cutting VAT on energy bills, but after the recent self-inflicted economic fiasco, it will have to be properly budgeted for (potentially through an expanded windfall tax). Ultimately, though, we are reliant on the wholesale gas price, which continue to fluctuate.

Sadly, there is no quick fix to the cost-of-living crisis, and we are in for a challenging winter, but the signs are that things will slowly get better through 2023.

TOP “COST-OF-LIVING” INTERNET SEARCHES

Our editorial experts at Group SJR decode complex topics in finance, energy, tech, health and other industries for your audience. Get in touch.